Tax season is here, and you may be wondering if you need tax preparation services for your business. If you are a small business owner, a freelancer, or a corporation, you may think that you can handle your taxes by yourself. After all, you have a degree in accounting, right? Well, not necessarily. While it…

Read More

Small Business Tax Advice & Tips

Robert Hall & Associates accounting firm has 45 years of professional tax consulting to the small businesses of Glendale, Pasadena, Burbank, and other surrounding California cities. Get small business tax planning and preparation tips and advice to help you manage cash flow, plan for growth, assess risks, keep your books in order, and more below.

IRS Appeals: How Long Does It Take?

Facing a tax dispute or audit from the Internal Revenue Service (IRS) can be a stressful and time-consuming experience. However, taxpayers have the right to appeal IRS decisions if they disagree with the agency’s assessment of their tax liability. One common question that arises during the appeals process is, “How long does it take?” In…

Read More

Year-End Tax Planning: A Guide for Individuals and Businesses

Have you started tax planning? Or do you find the whole ordeal somewhat intimidating? From looking at the new legislation to correctly timing income to thinking about retirement plans to making the most of deductions, year-end tax planning is filled with dread for entrepreneurs, small business owners, and large businesses alike. While talking to a…

Read More

A Tax Guide for Solopreneurs: Self-Employed Tax Tips

If you’re filing taxes as a solo entrepreneur (sole proprietorship), you may be new to self-employed tax rules. Here are some tips and tricks to help you get the most out of your tax return. When filing taxes as a self-employed individual, it’s important to maintain accurate financial records, pay self-employment taxes, consider retirement contributions,…

Read More

Section 1202 and QSBS Guide For Startup Founders, Employees & Investors

Section 1202 of the Internal Revenue Code provides a substantial tax benefit to startup employees, founders, and investors. It allows startup shareholders to take advantage of exclusion from tax on the sale or exchange of Qualified Small Business Stock (QSBS). Qualifying for Section 1202 can have big benefits for people investing in Qualified Small Businesses…

Read More

A Guide To The Section 199A or QBI 20% Deduction

The Section 199A 20% deduction is one of the most important changes for businesses in decades. Section 199A of the Internal Revenue Code provides a deduction for qualified business income from sole proprietorships, partnerships and S corporations. It was enacted to provide relief for non-corporate taxpayers by providing them with an incentive to invest in…

Read More

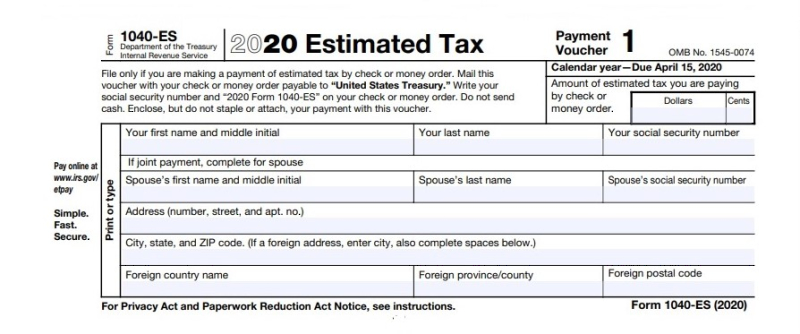

Making Electronic Estimated Tax Payments In California

Do you live in California? Electronic Estimated Tax payments are a great way to make your tax payments on time, and they’re easy to do. This article will teach you how it’s done! Electronic Estimated Tax is the easiest way to make your estimated tax payment if you live in California. With Electronic Estimated Tax,…

Read More

Signs You Should Get Professional Tax Assistance For Your Influencer Taxes

Social media influencers (generally) don’t have a lot of extra time in their day to manage proper tax preparation. This is a career driven by constant content creation and almost around-the-clock engagement with their followers. A lot of work goes on behind the scenes to keep a social media influencer operation running. Photography, filming videos,…

Read More

Is a Sole-Proprietorship, LLC or S-Corp the Best Legal Entity for Your Freelancer Business?

Though there are plenty of freelancers that have real success in running a totally bootstrapped business without ever thinking about how to structure it legally, there are a couple of big benefits freelancers would enjoy by incorporating their operation. Legal protection and taxes being the biggest of the bunch! At the same time, though, there’s…

Read More

Do Social Media Influencers Have to Pay Taxes?

It’s kind of amazing just how much of a role social media has come to play in our lives in just the last 10 years or so. A decade ago, it would have been (almost) impossible to imagine building a career on something like Twitter or Instagram. Today, though, there are thousands and thousands of…

Read More