Do you live in California? Electronic Estimated Tax payments are a great way to make your tax payments on time, and they’re easy to do. This article will teach you how it’s done! Electronic Estimated Tax is the easiest way to make your estimated tax payment if you live in California. With Electronic Estimated Tax, all of the information about your taxes will be automatically pulled from the IRS website by an Electronic Payment Service Provider (EPSP). You don’t even need to file any paperwork with the state of California!

Payment for Balances Due with Tax Returns:

Electronic Estimated Tax payments are really simple to do, and they can save you from paying penalties for filing your taxes late. Electronic Payments have a lower fee than paper checks, so it’s worth making the switch even if these forms look intimidating at first glance. Best of all – Electronic Estimated Taxes aren’t just easier on you; they’re much better for the environment, too! Electronic Tax Payments are easy to do using Electronic Payment Service Providers (EPSPs).

Steps for Electronic Estimated Tax payments:

- To make an electronic payment with California’s Franchise Tax Board, you’ll need to be logged into your EPSP account.

- Once you have your login information ready, go to Electronic Payments on the California Franchise Tax Board website.

- Enter your EPSP login information to get started.

Below are the links and directions on how to do this for balances with tax returns:

Federal: Pay at IRS Direct Pay: https://www.irs.gov/payments/direct-pay

- Choose “Make a Payment”

- Reason: Balance Due

- Apply Payment To: Income Tax – Form 1040

- Tax Period: 2020

California: Pay at the FTB Website: https://www.ftb.ca.gov/pay/bank-account/index.asp

- Payment Type: Tax Return Payment

- Tax Year: 2020

Payment For Extension Payments:

Electronic Estimated Tax Payments are a great way to make your tax payments before the deadline. Electronic Payment Service Providers (EPSPs) offer an extension payment for Electronic Funds Withdrawal, so you can pay your taxes even after the April 15th filing date! Electronic Extension Payments have a lower fee than paper checks, so it’s worth making the switch even if these forms look intimidating at first glance.

Steps for Electronic Estimated Tax payments:

- To make an electronic payment with California’s Franchise Tax Board, you’ll need to be logged into your EPSP account.

- Once you have your login information ready, go to Electronic Payments on the California Franchise Tax Board website.

- Enter your EPSP login information to get started.

Below are the links and directions on how to do this for extension payments:

Federal: Pay at IRS Direct Pay: https://www.irs.gov/payments/direct-pay

- Choose “Make a Payment”

- Reason: Extension

- Apply Payment to: 4868 (for 1040, 1040A, 1040EZ)

- Tax Period for Payment: 2020

California: Pay at the FTB Website: https://www.ftb.ca.gov/pay/bank-account/index.asp

- Payment Type: Extension Payment (form 3519)

- Tax Year: 2020

Payment For Estimated Payments:

Estimated Tax payments are a great way to make your tax payments on time, and they’re easy to do. Electronic Payments have a lower fee than paper checks, so it’s worth making the switch even if these forms look intimidating at first glance. Best of all – Electronic Estimated Taxes aren’t just easier on you; they’re much better for the environment, too! Electronic Payment Service Providers (EPSPs) provide electronic funds Withdrawal as an option when paying with paper check or Direct Debit/ACH withdrawal from your bank account.

Steps for estimated tax payments:

- To make an electronic payment with California’s Franchise Tax Board, you’ll need to be logged into your EPSP account.

- Once you have your login information ready, go to Electronic Payments on the California Franchise Tax Board website.

- Enter your EPSP login information to get started.

Below are the links and directions for Estimated Taxes:

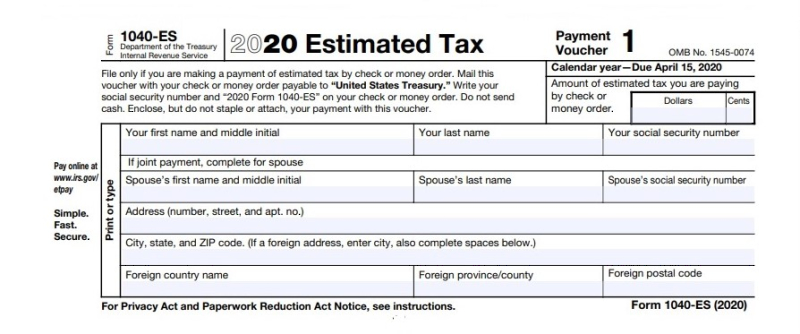

Federal: Pay at IRS Direct Pay: https://www.irs.gov/payments/direct-pay

- Choose “Make a Payment”

- Reason: Estimated Tax

- Apply Payment to: 1040ES (for 1040, 1040A, 1040EZ)

- Tax Period for Payment: 2021

California: Pay at the FTB Website: https://www.ftb.ca.gov/pay/bank-account/index.asp

- Payment Type: Estimated Tax Payment (Form 540 – ES)

- Tax Year: 2021